Algorithmic trading, also known as algo trading, is a method of trading that uses computer programs to execute trades automatically. The use of algorithms can help traders to make faster and more accurate decisions, as well as to reduce the impact of emotions and biases on trading decisions. In this article, we will discuss the steps involved in algo trading.

Step 1: Define your trading strategy

The first step in algo trading is to define your trading strategy. This involves identifying the criteria that will trigger a buy or sell signal. This can be done using a variety of technical and fundamental indicators, such as moving averages, MACD, RSI, or news releases. The key is to identify a set of rules that are objective and can be programmed into a computer.

Step 2: Backtesting

Once you have defined your trading strategy, the next step is to test it using historical data. This is known as backtesting. Backtesting allows you to see how your strategy would have performed in the past and to identify any weaknesses or flaws. It is important to use a large sample of historical data and to include a variety of market conditions to ensure that your strategy is robust.

Step 3: Develop your algorithm

Once you have tested your strategy and identified any weaknesses, the next step is to develop your algorithm. This involves writing code that will execute your trading strategy automatically. The code will need to be written in a programming language such as Python, C++, or Java. It is important to ensure that your code is efficient, reliable, and easy to maintain.

Step 4: Test your algorithm

Before deploying your algorithm in a live trading environment, it is important to test it thoroughly. This can be done using a simulation or paper trading account. A simulation account allows you to test your algorithm using real-time market data, but without risking any actual money. This will help you to identify any issues or bugs that need to be fixed.

Step 5: Deploy your algorithm

Once you are confident that your algorithm is working as expected, the next step is to deploy it in a live trading environment. This involves connecting your algorithm to a brokerage or trading platform that supports algorithmic trading. You will also need to set up a server to run your algorithm and to monitor it for any issues.

Step 6: Monitor and refine your algorithm

After deploying your algorithm, it is important to monitor its performance and to make any necessary refinements. This may involve tweaking the parameters of your trading strategy, adding new indicators, or making changes to your code. It is important to continue testing and refining your algorithm over time to ensure that it remains effective in changing market conditions.

In conclusion, algo trading can be a powerful tool for traders who want to automate their trading strategies. By following the steps outlined in this article, you can develop and deploy your own algorithmic trading system. However, it is important to remember that algo trading is not a guaranteed way to make money and that it carries risks like any other form of trading.

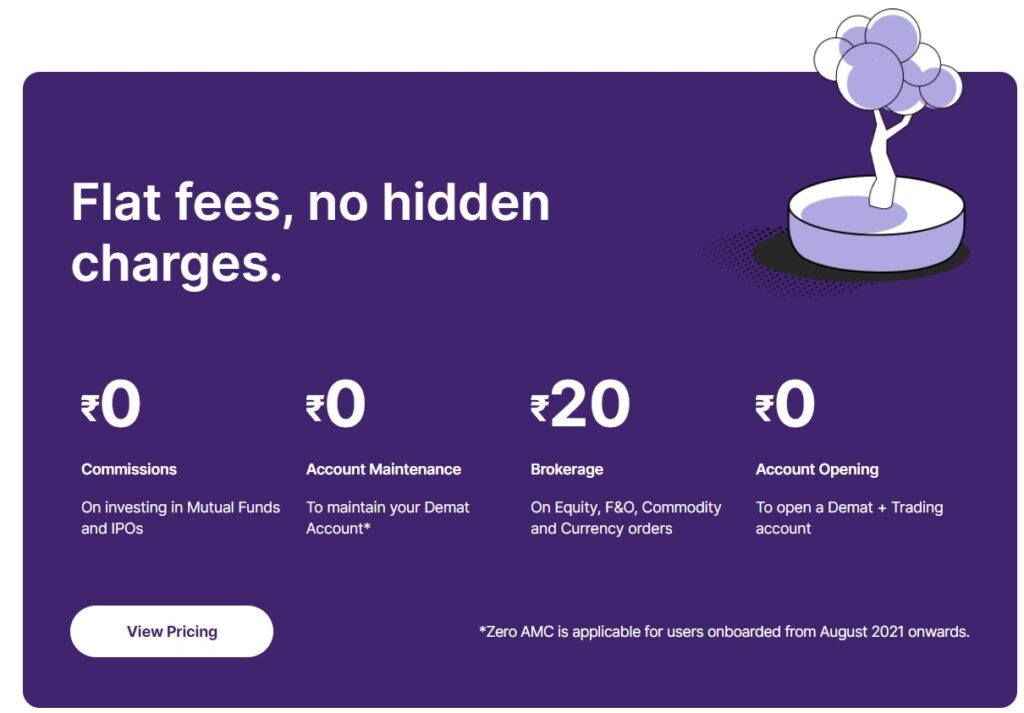

For free Interactive and historical data feed, open account with Upstox. We will use upstox api to develop our algo. Account open with our referral will get full technical support.

Use this link : https://upstox.com/open-account/?f=1TFG

0 Comments